Steve Willoughby offering to sell seven of his properties to recoup funds

Willoughby Homes's former boss will sell all seven of his properties to pay off the company's $5.7 million debt.

The director of a building company that went bankrupt has broken his silence and offered to sell all seven of his properties, some of which he has owned for more than a decade.

The director of a building company that went out of business will probably have to sell all seven of his homes to pay off the company's debts.

But even then, most creditors will only get between 1.7 cents and 5.7 cents for every dollar they are owed.

Willoughby Homes, a home builder in NSW, put itself into voluntary administration earlier this month. At a court hearing on Wednesday afternoon, the company was saved from being put into liquidation.

Gyprocking company Regno Trades started winding up Willoughby Homes at the beginning of July because Willoughby Homes owed them $184,000. Three other creditors also joined the case: H & R Interiors, which was owed $73,925, an ex-employee who was owed $53,000 in unpaid wages, and Finese Electrical and Air Conditioning, which was owed $4531.

So, the worst-case scenario for the proposal is that Regno Trades will get around $3200, or 1.7 cents on the dollar.

Willoughby Homes chose David Mansfield and Jason Tracy of Deloitte's turnaround and restructuring department to be voluntary administrators two business days before the first hearing on closing down the company. They were able to convince the judge to put off the case until August 31. Then, on Wednesday, it was put off again so that creditors could vote on what to do next.

Willoughby Homes went out of business because news.com.au did a thorough investigation and found that the company hasn't been working for a while. For example, construction sites have been stopped for up to a year, the company's home building insurance hasn't been renewed, and employees haven't been paid. Finally, all of the company's offices were cleaned out and its phone lines went straight to voicemail.

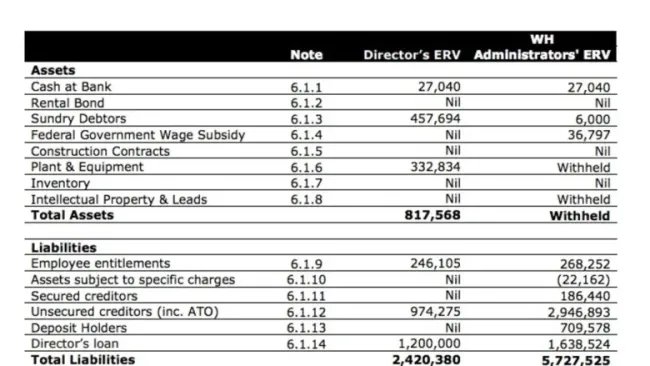

The administrators' report says that the collapse of the construction company has hurt 57 customers whose homes were in different stages of completion as well as other creditors who are owed a total of $5.7 million.

Steve Willoughby, who runs Willoughby Homes, has put forward a Deed of Company Arrangement (DOCA) that says he wants to sell seven of his properties and one camper trailer.

In an earlier statement to news.com.au, Mr. Willoughby said, "I am proposing to creditors that I sell properties I have owned for 10 years or more, even though I am not required to do so."

No one has been happy with the way the economy has been going."

Willoughby Homes would have only had $14,000 in the bank to give to all of its creditors if the director hadn't put up his or her own property.

Mr. Willoughby owned seven properties in Lethbridge Park, Narara, Earlville, Griffith, Hebersham, Kenthurst, and Harden. The value of these properties ranged from $220,000 to $2,000,000.

The Kenthurst property is the most valuable, but Mr. Willoughby's wife, Rochelle, owns half of it, and a big chunk of it was bought with a loan.

But when the claims of secured creditors are taken out of those funds, unsecured creditors are left with only $818,000. The people in charge have already been charged $250,000.

They thought that the assets would give the creditors between $409,063 and $654,501.

QC Hugh Smith, who was representing the administrators in court on Wednesday afternoon, said that 1.7 cents to 5.7 cents per dollar is "a small amount," but that it was "better than nothing."

On September 5, the proposal will be put to a vote.

Administrators also found that Willoughby Homes had been insolvent for 18 months and had taken deposits from 41 customers without having the insurance to do so.

The administrator's report said that it looks like Willoughby Homes may have been broke since at least April 21, 2021.

Willoughby Homes' insurance was not renewed by the state's insurance company, iCare, on April 21. This meant that the builder could not start any projects that cost more than $20,000 because they would not be insured.

"So far, our investigations have found 41 creditors who have paid deposits totaling $709,578 to the companies so that they can build their properties," the report said.

"As far as we know, none of these deposits are covered by the Home Building Compensation Fund (HBCF)."

In a previous court case, it was decided that Willoughby Homes was "hopelessly bankrupt" and that the company "failed so miserably."

Mr. Willoughby said that not getting insurance was one of the main reasons why his company went out of business, along with lockdowns caused by Covid, a tough market, and rising costs of materials and labor.

Some customers are going to get most of the deposits they paid back, which is good news.

The administrators said they would try to give "priority" to the 41 customers who paid a deposit but are not insured. These customers are the ones who paid a deposit but are not covered by insurance.

But the lawyer for another creditor, Kamaljit Pawar, Rodney Kent, said it was unfair that everyone else owed money.

Mr. Kent said earlier this month, "My client is just as vulnerable as anyone else. All of their businesses could fail if they don't get paid."

As a lawyer for Regno Trades and three other creditors, Peter Fary agreed.

Mr. Fary said, "This is a very strange order of things. On the one hand, you have 100 cents to the dollar, and on the other, you have 1.7 cents to the dollar."