David Paradice missed out $1 billion on GameStop share price surge

It's really crazy: no regrets over Australian investor losing $1b GameStop windfall

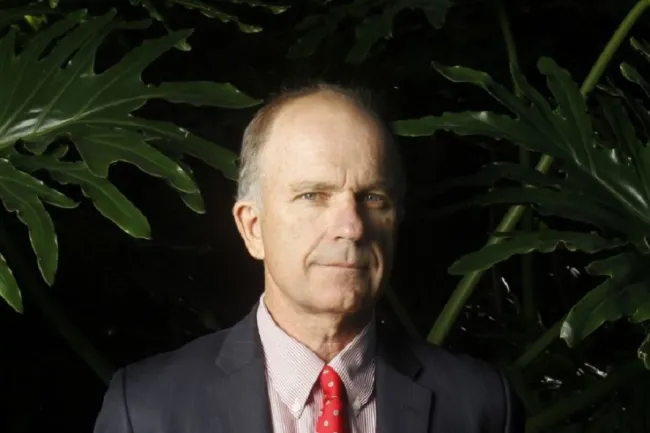

David Paradice, an Australian investment legend, has seen many things throughout his distinguished career in fund management. But nothing like the online hysteria that last week led to an unprecedented spike in the shares of the obscure US GameStop retailer. "It was crazy to watch, and it was very interesting, too," Mr. Paradice said. "It's madness, really."

As this masthead disclosed last week, after selling shares in GameStop just before a day of trader rebellion led to an unprecedented rise in stock, Paradice's fund management company Paradice Investment Management missed out on a possible $1 billion windfall.

But speaking from his Denver office, Paradice says that he doesn't regret the move. For us, we have a lot of seasoned guys evaluating stocks. We spend a lot of time observing markets and stocks and the momentum of trading.

That's why we can all sleep peacefully every night because we know how we spend, invest in fundamentals and we don't do the insane things," he says."

The GameStop share price spike has captivated the global media, prompted regulatory alerts and ignited predictions that the advent of a new type of investment could permanently alter financial markets.

In January, shares in the previously unloved American video game retailer shot up more than 1500 percent after large numbers of retail day traders banded together on Reddit website discussion boards to drive up the stock price and decimate the hedge funds that had billions riding on the plummeting shares.

Paradice, who divides his time between the US and Sydney, is one of the most regarded fund managers in Australia, and, according to the Financial Review Rich List last year, had a net worth of $613 million. Paradice Investment Management supervises $17 billion worth of portfolios.

Sources estimate that in December and January, Paradice sold its GameStop shares for between $US32 million and $US34 million, a major improvement on the $US9 million the shares were worth in 2014 when it first disclosed its ownership to the US Stock Exchange Commission.

If Paradice had held onto its GameStop investment and then sold at the height of the retail investor frenzy, the fund could have netted $US855 million ($1.1 billion) as shares reached a whopping $US483.

Paradice listed the increased share price of GameStop in its September update (at the time to about $US18) as a key contributor to the success of its global fund for small caps.

As an example of retail investors fighting back against powerful Wall Street interests, US politicians have jumped upon the GameStop frenzy, but the truth of the situation is more complicated.

And Paradice is keen to point out that on behalf of superannuation and pension funds, including non-profit sector funds, Paradice Investments is investing capital.

"We're running cash for the big mega funds. The way I look at it is that I run cash for little guys' truckloads and it's my job to make sure that we really need capital preservation and downside security, he says.

"It's not about shooting the lights out, because a massive amount of volatility results from that approach."

"If you just stick to the basics and do the right thing, the rest ought to follow."