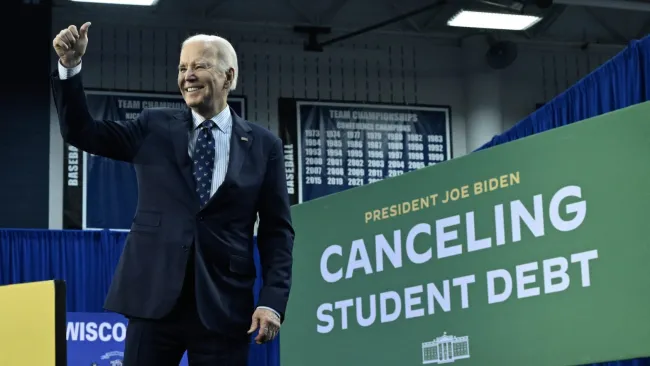

Biden's Student Loan Redemption: Judge's Ruling Sparks Hope, But Legal Storm Looms Ahead!

In a jaw-dropping twist that could revolutionize the financial futures of over 25 million Americans, a federal judge has just thrown a lifeline to President Biden's beleaguered student loan forgiveness program by lifting a restraining order that has kept borrowers shackled in crushing debt.

But before you start popping the champagne, let’s not delude ourselves—this hard-fought victory is shrouded in uncertainty, as a legal tempest brews on the horizon, threatening to extinguish the promised relief before it can even take root. U.S. District Judge J. Randal Hall’s ruling, issued late Wednesday from Georgia, has ignited a glimmer of hope in President Biden’s uphill battle against a relentless barrage of legal challenges designed to undermine his administration’s efforts to alleviate the suffocating burden of federal student loans.

With this ruling, the administration is now positioned to finally unveil a plan that could potentially offer partial or full forgiveness to borrowers gasping for financial air—especially those whose loans have skyrocketed into unmanageable mountains due to astronomical interest rates and individuals trapped in dead-end career training programs that promised success but delivered only hardship.

However, let’s be clear: this pivotal ruling comes at an incredibly precarious time—just weeks before the high-stakes Nov. 5 presidential election, where the specter of student debt looms ominously over voters. The legal drama reached a boiling point last month when seven Republican-led states—Missouri, Georgia, Alabama, Arkansas, Florida, North Dakota, and Ohio—fired a legal cannonball at the Biden Administration, alleging that the forgiveness plan would drain state resources and unfairly burden taxpayers. This political chess match reveals how deeply entangled student debt has become with the fabric of American politics, transforming it into a hot-button issue that could decisively sway the electorate.

In a delicious twist of fate, Judge Hall dismissed Georgia from the lawsuit, ruling that the state had failed to demonstrate any substantial harm from the program. Now, the case has shifted to the Eastern District of Missouri, where Attorney General Andrew Bailey is leading the charge, asserting that the Missouri Higher Education Loan Authority (Mohela)—a quasi-state agency responsible for servicing federal student loans—would face catastrophic financial losses if the program is allowed to move forward.

While advocacy groups are popping confetti over this ruling as a crucial step toward dismantling the chains of student debt, they remain acutely aware of the storm brewing on the horizon. “This case is far from over,” cautioned the Student Borrower Protection Center. “The Administration must not allow the Missouri Attorney General to dictate terms and must ensure that borrowers receive the relief they rightfully deserve.”

Among the standout features of Biden’s plan is the proposal to eliminate up to $20,000 in accrued interest for eligible borrowers, regardless of their income levels. This means that single borrowers earning less than $120,000 and married couples with an income under $240,000 could finally catch a breath—provided they enroll in an income-driven repayment plan. The White House proudly touts this initiative as a potential game-changer for over 25 million people, projected to cost taxpayers an eye-popping $147 billion over the next decade.

This push for relief comes hot on the heels of a Supreme Court ruling in 2023 that decimated Biden's earlier attempt to wipe away up to $20,000 in student debt for more than 40 million borrowers. Now, the focus has shifted to those who have fallen through the cracks, specifically targeting the long-term fallout from student loans that have spiraled out of control due to predatory interest rates that leave borrowers feeling trapped and hopeless.

While the lifting of the restraining order allows the Education Department to forge ahead with new regulations, immediate relief is still far from guaranteed. The Biden Administration is racing against time to finalize and publish the new rule, expected later this fall. Meanwhile, GOP-led states are preparing to file for an injunction aimed at blocking the regulation, casting a shadow of uncertainty over millions of borrowers who are desperate for a lifeline.

Biden’s relentless push for student debt forgiveness has evolved into a defining pillar of his policy agenda, with the objective of restoring hope for millions who find themselves drowning under the weight of their loans. Education Secretary Miguel Cardona emphasized the urgency of this issue in a recent interview, declaring, “Higher education has been out of reach for too many Americans. We’re working to fix a broken system—debt relief is a vital part of that solution.” Cardona highlighted that over the past three years, four million people have benefitted from debt relief initiatives, with one in ten student borrowers seeing around $160 billion lifted from their financial burdens.

As the legal battles rage on, the stakes have never been higher. Will Biden’s audacious plan finally succeed in cutting through the fog of legal opposition, or will the formidable resistance drown out the voices of millions desperately seeking relief? With each passing day, the tension mounts, and the fight for student loan redemption is far from over. As the election draws near, one thing is abundantly clear: the struggle for student loan relief is on track to become one of the defining issues of this election cycle.

As the political landscape shifts and the stakes rise higher, millions of Americans are left grappling with a nagging question: will relief finally be within reach, or will their dreams of financial freedom be crushed yet again under the weight of an unforgiving system?